schedule c tax form llc

The owners of an LLC are members. There is generally no distinction between the business owner and the LLC for income tax purposes.

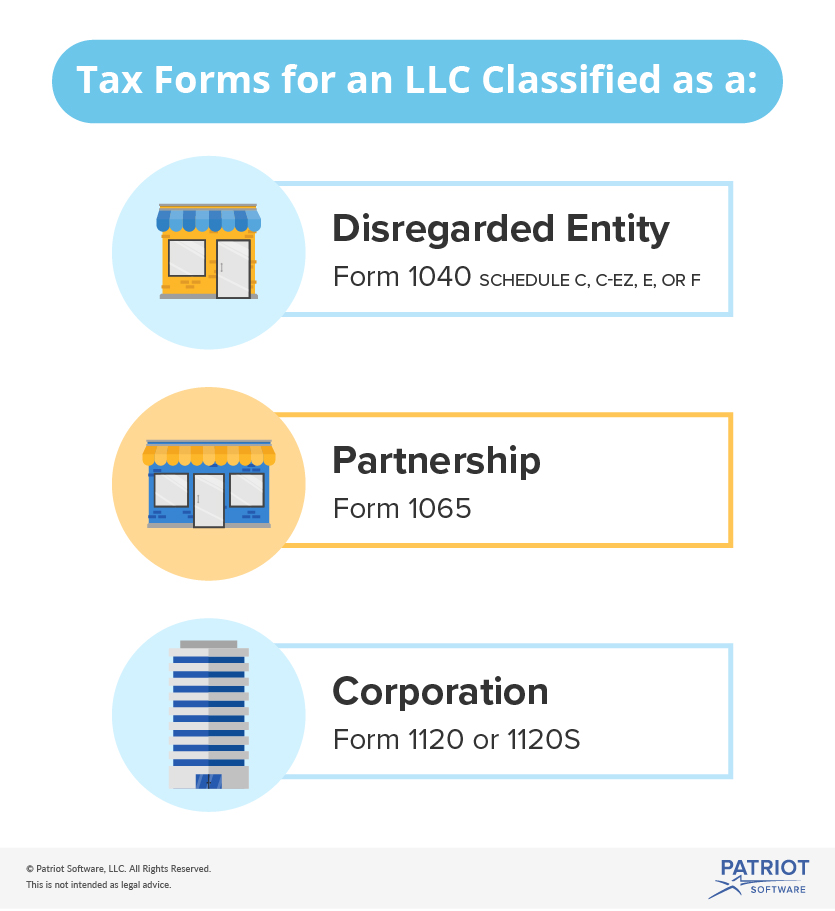

Tax Forms For An Llc Federal Forms Llcs Should Know About

New York City.

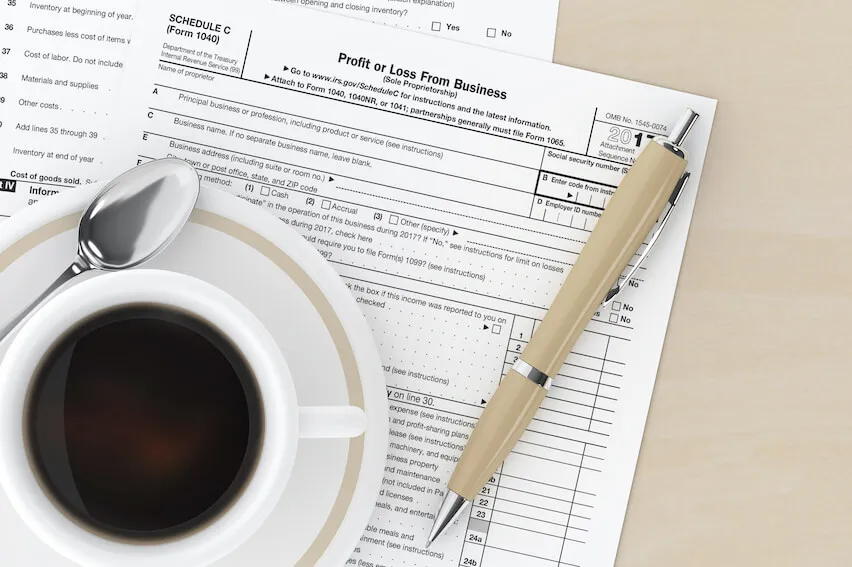

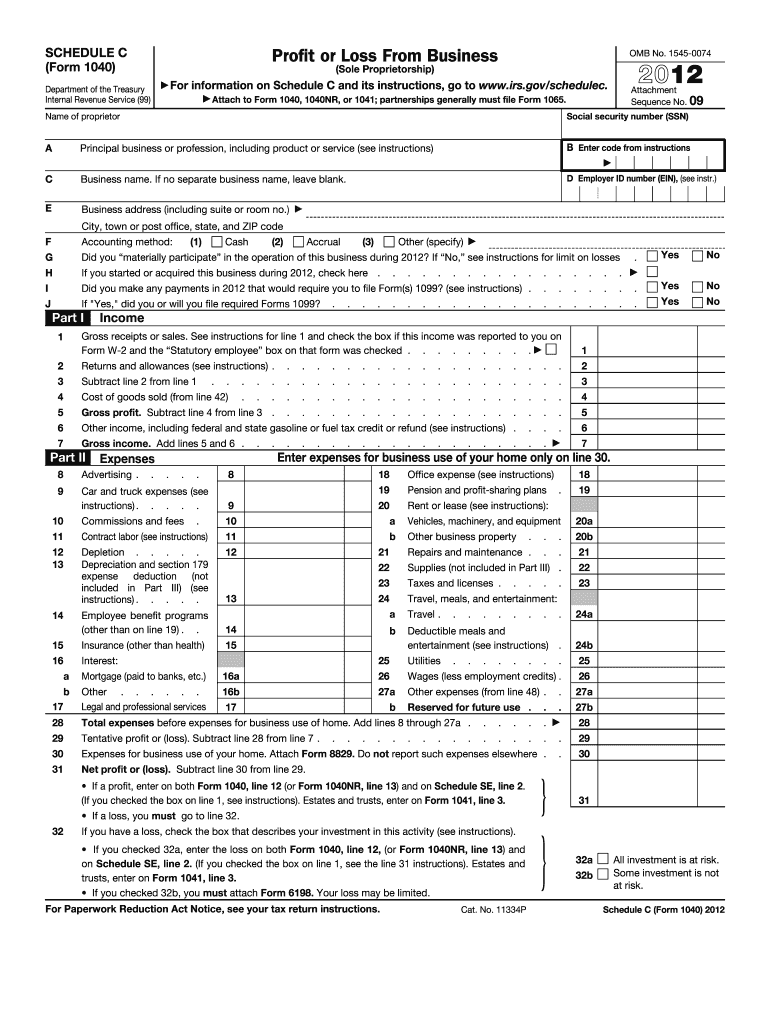

. Schedule C is for two types of business - a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation. Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. The IRS website has a copy of the Schedule C tax form as well as Instructions for Schedule C.

The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. Application Note to supervisor. This is a friendly reminder that rsmallbusiness is a question and answer subreddit.

Supervisor Information Form Please put a check in the box next to the type of application the applicant is submitting. For advice and counsel that can reliably help you. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United.

The profit is the amount of money you made after covering all. It is a form that sole proprietors single owners of businesses must fill out in the United States when. Only charge is the Annual Franchise Tax fee paid to maintain the LLC.

The Schedule C tax form is not for. Converting your S corporation to an LLC takes careful planning and a detailed knowledge of both business entity law and the Tax Code. You can form an LLC to run a business or to hold assets.

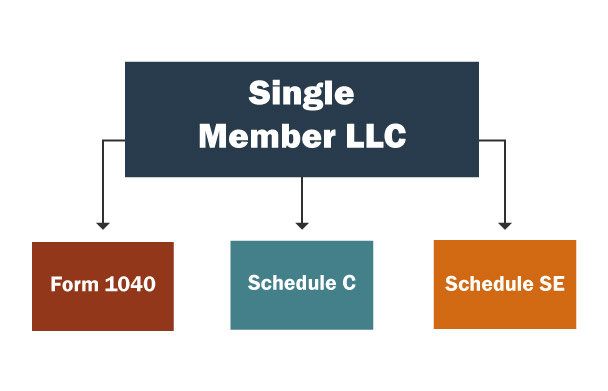

Even simple sole proprietorships usually require multiple other. A limited liability company LLC blends partnership and corporate structures. A single-member LLC is a business entity owned by just one person.

Schedule C Form 1040 is a form attached to your personal tax return that you. The Schedule C tax form is used to report profit or loss from a business. Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Single-Member LLC and.

You ask a question about starting.

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

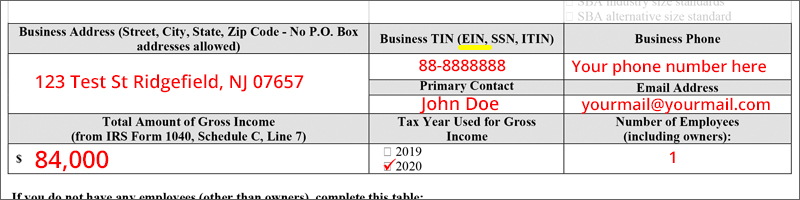

New Self Employment Gross Income Ppp Loan Application Guide

What Tax Form Does An Llc File

Navigating Freelance Taxes In 2020

Understanding The Schedule E For Rental Properties Rei Hub

Filing Schedule C Form 1040 In 2022

How To Fill Out Schedule C For Business Taxes Youtube

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms

How To File Your Llc Taxes Truic

Prepare Paycheck Stubs Paystubs W2 1040 Schedule C 1099 By Tax Teacher Fiverr

Schedule C Pdf Fill Online Printable Fillable Blank Pdffiller

Tips On Using The Irs Schedule C Lovetoknow

How To Single Member Llc Sole Proprietor Taxes Dp

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

Federal Corporate Tax Preparation Preparing C Corp S Corp And Llc

Business Activity Code For Taxes Fundsnet

Amazon Com Easy Tax Pro 2020 Easy Tax Workbook For 2019 Tax Returns Easy Tax Pro Llc 9781652375296 Drobnick Sr Timothy L Books